2021 electric car tax credit california

5 Symptoms of a Bad Front and Rear Wheel Bearings. Please subscribe to our newsletter to receive updates related to California tax legislative and economic themes that may impact you.

Ev Incentives Ev Savings Calculator Pg E

Learn more about EV tax rebates in CA.

. Californias Electric Car Incentives 2021. Many utilities and local areas also offer incentives. Funds for this program may become exhausted before the fiscal year ends but applicants will be placed on a rebate waiting list in this case.

Standard Rebate of 2500 for purchase or lease of a new electric vehicle with a base price under 50000. This California EV rebate typically awards between 1000 and 3500 for plug-in hybrids. SUBJECT Electric Vehicle Charging Credit SUMMARY The bill provides under the Personal Income Tax Law PITL and Corporation Tax Law CTL a 40 percent credit for costs paid or incurred to the owners or developers of multifamily residential or nonresidential buildings for the installation of electric vehicle.

This nonrefundable credit is calculated by a base payment of 2500 plus an additional 417 per kilowatt hour that is in excess of 5 kilowatt hours. You must fill out IRS Form 8936 when filing your annual income tax returns. 500 per Level 2 vehicle supply equipment and 2500 per direct current fast charger.

7000 for FCEVs 4500 for EVs 3500 for PHEVs. For low to moderate-low-income to moderate-income buyers. Clean Vehicle Rebate Program CVRP Get up to 7000 to purchase or lease a new plug-in hybrid electric vehicle PHEV battery electric vehicle BEV or a fuel cell electric vehicle FCEV.

Tesla Model S Long Range. If you purchased a new EV in May of 2021 you would apply for the tax credit when you file your 2021 taxes at the beginning of 2022. How Much is the Electric Vehicle Tax Credit for a 2021 Tesla.

Vehicle Vehicle Type Full Credit. Battery electric vehicles get a standard 2000 incentive and hydrogen fuel-cell vehicles get a standard 4500 break. Toyota Prius Prime Plug-in Hybrid.

The credit amount will vary based on the capacity of the battery used to power the vehicle. The IRS tax credit for 2021 Taxes ranges from 2500 to 7500 per new electric vehicle EV purchased for use in the US. Charge Ahead rebate of 5000 for purchase or lease of a new or used electric vehicle with a base price under 50000 for eligible customers.

Well many EV owners are not aware of the benefits they can potentially rate for being an electric car owner. Keep in mind that not all online or software-based tax systems support this form. State-based EV charger tax credits and incentive programs vary widely from state to state.

Fueling equipment for natural gas propane liquefied hydrogen electricity E85 or diesel fuel blends containing a minimum of 20 biodiesel installed through December 31 2021 is eligible for a tax credit of 30 of the cost not to exceed 30000. Bill Analysis Bill Number. 2021 Electric Vehicles Tax Credits.

Tesla Model 3 Long Range. A qualified taxpayer would be allowed a maximum credit for installations during the taxable year of. Or maybe you already own an electric car and youre wondering what incentives you rate as an electric car owner.

The state of California has their own cash rebate program for its residents who. Federal Tax Credit As of Jan 1 2020 Eligible for CVRP California CVRP Rebate As of Dec 3 2019 Range miles MSRP MSRP - Fed Calif. For vehicles acquired after 12312009 the credit is equal to 2500 plus for a vehicle which draws propulsion energy from a battery with at least 5 kilowatt hours of capacity.

As of 2021 California Florida Texas and. Unlike the federal tax credit the California rebate comes in the form. Solar and Energy Storage.

The amount varies depending on the state you live in but you can expect to receive anywhere from 500 to 5000 back with your purchase or lease. Federal Tax Credit Up To 7500. Beginning on January 1 2021.

All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500. The amount you receive may also be based on income eligibility. In addition to federal tax credits many states also offer rebates when you purchase or lease an electric vehicle.

CVRP offers vehicle rebates on a first-come first-served basis and helps get the cleanest vehicles on the road in California by providing consumer rebates to reduce the initial cost of advanced. And 4500 to 7000 for fuel cell electric vehicles. In this blog we will discuss what the credit is how it works and more.

State andor local incentives may also apply. Small neighborhood electric vehicles do. That amount is the cutoff point.

Taxpayers may receive up to 7500 as a federal tax credit for electric cars in 2022. A battery-electric vehicle BEV with a rating of 25 kWh per 100 miles costs approximately 375 dollars per year or 3125 per month to charge at a rate of 10 cents per kWh. The incentives go up as high as 12500 on new cars and up to 4000 on used electric vehicles.

EV Charging Incentives by State. Plug-in hybrids get 1000 battery-electric cars can get a 2000 rebate and hydrogen fuel-cell cars are eligible for 4500. Tesla Model S Performance.

Does the EV Tax Credit Apply to Used Cars. Qualified Plug-In Electric Drive Motor Vehicles IRC 30D Internal Revenue Code Section 30D provides a credit for Qualified Plug-in Electric Drive Motor Vehicles including passenger vehicles and light trucks. Discover electric vehicle tax credits in California and buy a new Toyota PHEV at our Victorville Toyota dealer.

If a single person purchases two eligible plug-in electric vehicles with tax credits up to 7500 for each vehicle they should be able to claim 15000 in. We are financial advisors in La Jolla CA. If you purchase or lease a plug-in hybrid and live in California you could also be eligible to receive a 1000 standard rebate.

But if someone owes more than 7500 in taxes then they cannot claim a higher tax credit than 7500. 4500 for fuel cell electric vehicles FCEVs 2000 for battery electric vehicles 1000 for plug-in hybrid electric vehicles PHEVs and 750 for zero emission motorcycles. The Clean Energy Act for America would benefit Tesla by allowing most Tesla vehicles to qualify for an 8000 House version or 10000 Senate version refundable EV electric vehicle tax credit while discouraging Chinese EVs from entering the US market.

The EV tax credits that are being proposed for 2022 are larger and more robust than previous and current electric vehicle tax credits. The maximum amount that their tax credit can be is 5000. Permitting and inspection fees are not included in covered expenses.

Toyota RAV4 Prime Plug-In Hybrid. You can search for the vehicle and then apply for the rebate. And potentially even more importantly these tax credits will be refundable.

2000 to 4500 for battery electric vehicles. Hey Californians so youve decided that you wanted to switch to an electric car. And April 7 2021.

How Do Electric Car Tax Credits Work Credit Karma

Latest On Tesla Ev Tax Credit March 2022

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

How Do Electric Car Tax Credits Work Kelley Blue Book

Toyota Mirai 7 500 California Tax Credit Eligibility Toyota Of Hollywood

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

California Ev Incentive Is Getting Smaller In November

Electric Vehicle Tax Credits What To Know In 2022 Bankrate

The Ev Tax Credit Can Save You Thousands If You Re Rich Enough Grist

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Electric Vehicle Purchase Guidance Program Monterey Bay Electric Vehicle Alliance

Top States For Electric Vehicles Quotewizard

Southern California Edison Incentives

2021 Jeep 4xe Hybrid Tax Credits Incentives By State

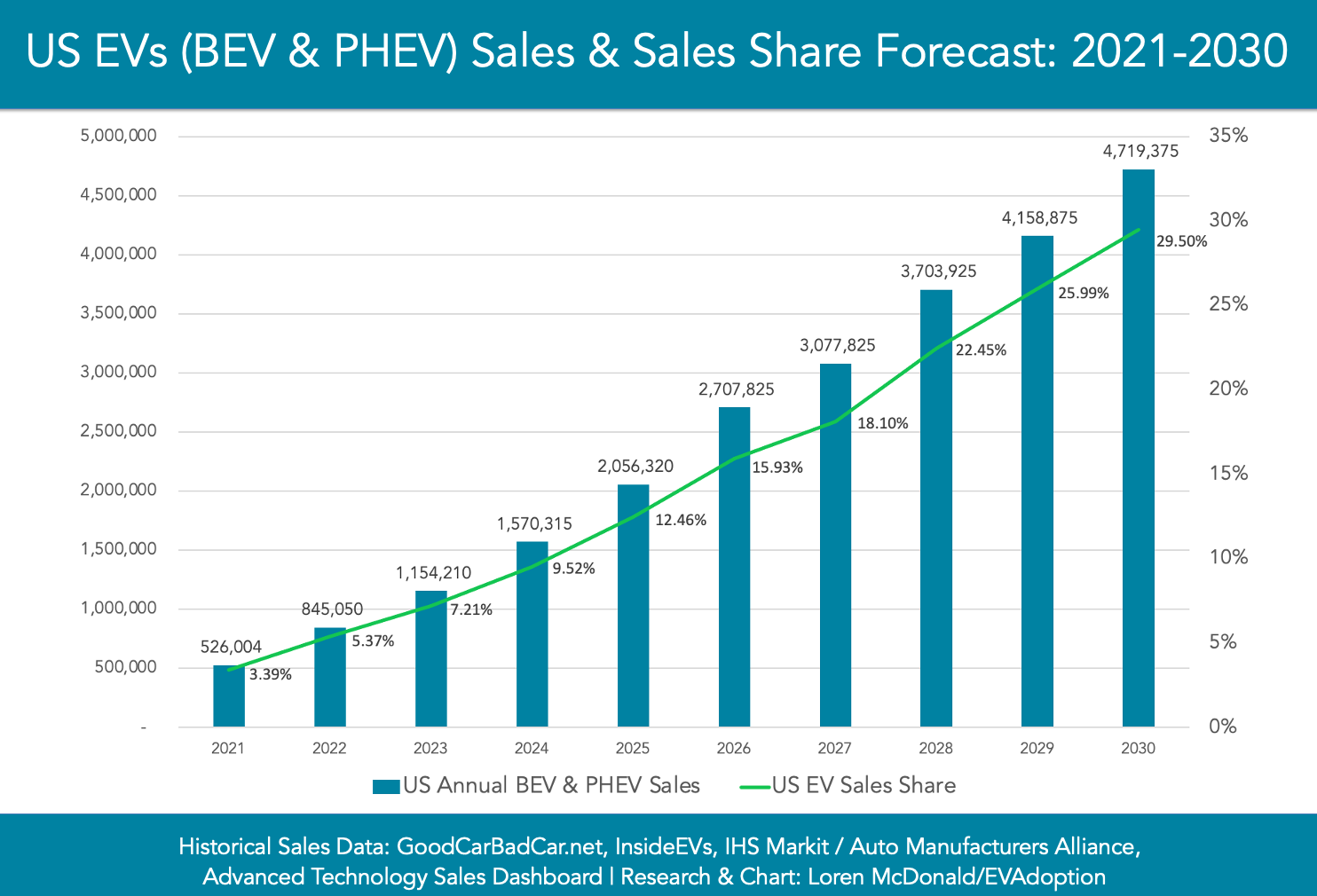

How The Federal Electric Vehicle Ev Tax Credit Works Evadoption